Top Valuations: Billion-Dollar Players (Part 2: Unicorn Companies Series)

Today we will continue our series of posts about Unicorns.

We will start with a specific column named “Valuation”. In order to drill down we first need to know the meaning of the word “Valuation”, am I right?

Why does a company need a price valuation? We will start with the definition.

Valuation, same as the word “Value”, is a process of determining the worth of an asset or company. The price valuation is important in order to provide prospective buyers with the information of how much they should pay the price for purchasing an specific asset or a company, from the insight perspective of the sellers. Usually the assertion of the valuation was usually made by the big accounting firms.

Now that we are a little bit more familiar with this term, let’s dive into our next question. It would be fascinating if we knew which companies got the top valuation price? And in what industry the company is involved?

In order to find out the answer for our questions, I will add a chuck of my code - and find out what’s the output result.

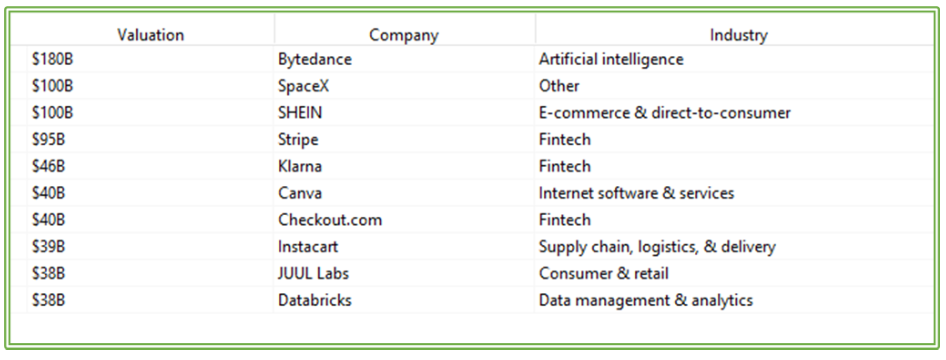

Here is the result what we got:

As we go through the output code - we can notice companies such as: Bydance or Spacex or SHEIN got a tag price valuation of more than 100 billion dollars.

Here below, we got 10 companies, when every company has a valuation price more than 38 billion dollars. We can also see that the industry group who led the price values on the companies was the fintech industry companies.

We can emphasize the output numbers by adding an illustration chart to the picture.

Now, after we got the numbers, we can go further and build our chart. Thus, I add the code with comments.

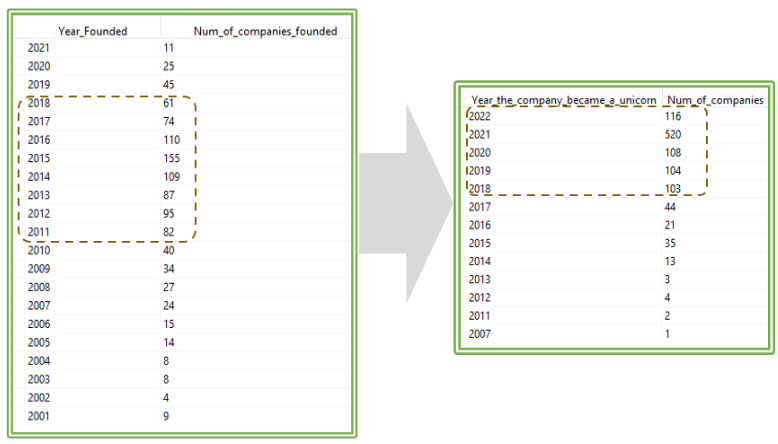

The next thing we would like to check is the amount of companies founded each year. As we can see down here ( In the left side table) : between the years 2011 - 2018 there was a massive increase of Hi - tech companies who started a business, which will turn out to be, over a couple of years, a unicorn.

Furthermore, We can see throughout the right side table the outcome result of the funding companies we talked about.This reflection is a consequence of more money and more bubbly behavior of the market, as many companies announced worth more than 1 billion dollars.

On the other hand, we can see a totaly different picture. We can point out what can drive the downward trend :

- During 2021, crossover investors like Tiger Global Management and Coatue Management ratcheted up their private-market dealmaking, pouring massive amounts of capital into funding rounds that sent valuations skyrocketing.

- In 2022, however, the meteoric growth has not been able to sustain itself.

- The venture market shrinked - At 2022, venture funding has shrunk with each passing quarter, with some crossover investors pulling back significantly after experiencing massive losses in their public funds. Over the last year there were several macro changes. Macro trends like inflation, rising interest rates, and geopolitical crises — such as the war in Ukraine — arose to shock the public markets.

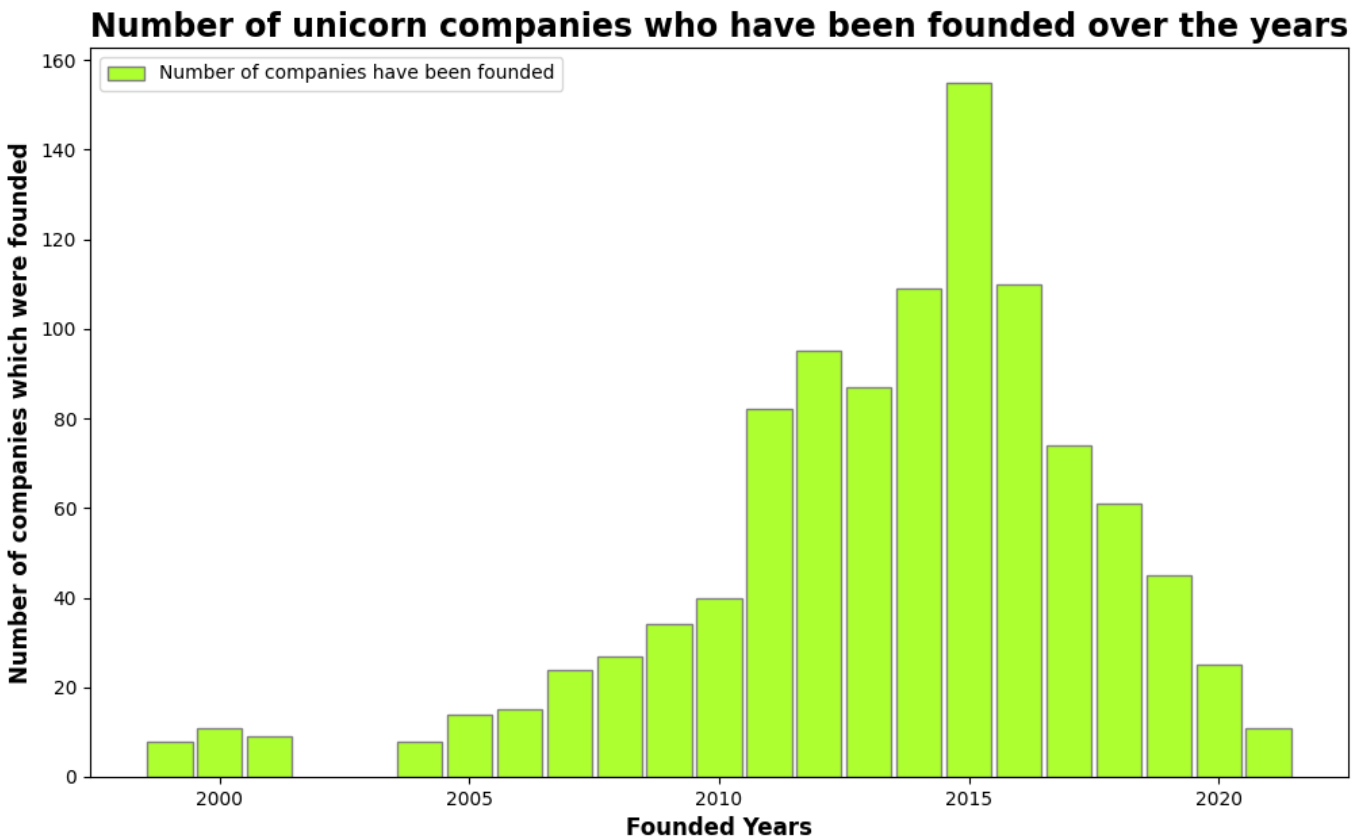

After we retrieve the numbers, we will go to the illustration data part. As we can see the visualization helps us to reinforce the numbers shown above: We can see a massive flow of opening business periods between the years at 2011 - 2018, especially at 2015 when 155 companies started to establish themself as a company.

The chart up here shows us the bubbly market the last couple of years. We can notice a dramatic change upon the valuation of companies. During the year 2021, 520 new unicorns were born. Those unicorn investments into tech startups exploded the same year. As for 2022, fewer unicorns are being minted - only 116 Unicorns got births. This movement of the market, which indicates a decline of nearly 350% (from 521 unicorns to 116 unicorns) only shows the massive drop-off so far.

We can also read the article published by the bloombeg newspaper - as written here - There Are Now 1,000 Unicorn Startups Worth $1 Billion or More - which gives us emphasis on the bull market result.